Example of how to perform a fundamental analysis in crypto

So, you’ve found a cryptocurrency that has piqued your interest, but how do you actually put fundamental analysis into practice?

Here we’re going to breakdown how to perform a simple but comprehensive fundamental analysis of a large-cap crypto (Ethereum), so you can get an idea of how FA works across different assets. If you haven’t read our article on what is a fundamental analysis, check out that one out first. Okay, let’s dive in.

Case Study 1 (Large-cap): Ethereum (ETH)

(FA performed on the 22/6/2021)

Market Cap

While most fundamental analyses should usually begin with figuring out a coin’s utility (what the cryptocurrency actually does), Ethereum is the second largest crypto by market cap so it makes sense to consider this fact before anything else.

Looking at the crypto space as a whole, it is clear to see that Ethereum is the only other cryptocurrency that comes close to rivalling Bitcoin, making it the no. 2 option for people looking to get exposure to crypto with as little risk as possible.

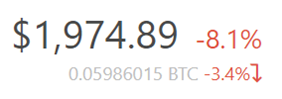

Currently, the market cap of Ethereum is at $230,579,453,630 USD, and the price of Ethereum is down at around $2,000 USD after seeing a downwards move in the past months and also in the last 24 hrs (-8.1%).

With a market cap of over $200 billion USD (around $150 billion more than the next largest cryptocurrency), you can immediately see that Ethereum is one of the most stable and proven investments in the crypto market.

If you were to use CoinGecko or Coin Market Cap to view the historical data of Ethereum, you would also see that in the past Ethereum’s market cap has been above an impressive $500 billion ($4,356.99 per coin) just few months. So, if you were looking for a long-term investment with less risk than other cryptos, Ethereum is a good choice (and now might even be a good time to buy given it is at less than half its all-time-high – the rest of the FA should help us decide).

The Utility & Use-case

Now that we’ve identified what kind of investment Ethereum is (large-cap, low-med risk), just a bit of research (on Google/Youtube/popular crypto sites) shows that Ethereum’s utility is both groundbreaking and also one that has proven to be in great demand.

While Bitcoin is digital currency, Ethereum is not just a form of digital currency but also a platform which facilitates the creation of smart contracts, decentralised applications and other cryptocurrency projects. It’s essentially a decentralised version of the internet where people can do just about anything you can think of, without middlemen and third parties being involved.

According to Ethereum’s website:

Pretty cool, right?

Ethereum’s open platform has led to thousands of other crypto projects (ERC-20 tokens) being built on top of Ethereum’s Blockchain, which is a big reason why Ethereum has seen some incredible price action over the last couple of years.

Having a glance at some of the most well-known cryptos built on Ethereum reveals that this hybrid cryptocurrency/platform is the real deal and, in many ways, has more potential for growth than any other coin. Some of the biggest cryptos, including Chainlink, Tether, Wrapped Bitcoin, OmiseGo, Maker, Golem, Aave and Basic Attention Token, rely on the Ethereum Blockchain, indicating that there’s a pretty good chance Ethereum will be around for a while.

Finally, Ethereum’s smart contract and decentralised application capabilities have allowed it to become the home of decentralised finance (DeFi) which many news articles, videos and anyone in the crypto-space will confirm is a BIG deal. A screenshot from the website:

Finally, think about which current, non-crypto industries a cryptocurrency/Blockchain project could potentially disrupt, optimise or even revolutionise. In Ethereum’s case, given it’s a platform for countless other crypto projects, this seems to be one of its main selling points as it has the potential to impact virtually every industry. Keeping in mind how society could benefit from a crypto’s utility is a good way to size up its true, long-term potential.

Asking if a cryptocurrency is actually useful/in demand is always good. With Ethereum, it is a resounding ‘YES’ – compared to the utility of most other cryptocurrencies, Ethereum is a step above.

The Team (developers, advisors, partnerships)

Given the proven success and the status of Ethereum, it is safe to assume they have some serious developers and some of the best partnerships in the game. Doing a bit of Googling on this cryptocurrency will also reveal that cryptocurrency’s no. 1 wonder kid, Vitalik Buterin, is the main founder of Ethereum and is still leading the project. There are few names as respected as Vitalik’s, so this is a great sign.

On top of that, two of the original founders in Charles Hoskinson and Gavin Wood, have since left Ethereum to start rival Blockchains. While these two names are in the same league as Vitalik’s, the fact they left to start competing projects may indicate that Ethereum has some flaws and potentially formidable competition, so let’s look into that next.

The Competition

If you’ve poked around some online communities you will see that there are those who LOVE Ethereum but also those who think the no. 2 cryptocurrency is destined to fail. Looking into Ethereum’s limitations and disadvantages reveals that there are a few main concerns:

Scalability – the no. 1 criticism of Ethereum. Ethereum has so many things going on that it has consistently struggled with network congestion in the past, given the sheer number of people using it. This has led to slow transaction times and ridiculously high gas/transaction fees for those using Ethereum’s network/those wanting to buy Ethereum (and other ERC-20 tokens). This is a major problem if this cryptocurrency is going to keep growing and serving a large number of people.

Resource intensive – Currently, Ethereum is still a Proof of Work crypto, meaning you can ‘mine’ Ethereum. This means a lot of energy goes into the creation of new coins, which is not ideal for a rapidly growing project that cares about its environmental impact. However, Ethereum is also transitioning (slowly) to the far more sustainable Proof of Stake model, which is a good sign (though it may take some time for this process to occur).

Complicated programming language – Another potential limitation is that Ethereum’s Blockchain has a pretty complex programming language, which may make it hard for beginners to the space to get involved.

Given these concerns, there are undoubtedly going to be other cryptocurrencies in the space who are trying to steal Ethereum’s throne. Some of the most notable competitors are Binance Smart Chain, Polkadot, Cardano, Terra, and Solana.

A quick look into any of these projects shows that they are as legit as they come. Many of them have been specifically designed to address Ethereum’s concerns (like Solana, whose transaction speeds are on another level entirely), and they have all achieved very impressive market caps, indicating that Ethereum has some real competition.

However, while it may be a deterrent that other, more technologically advanced cryptocurrencies similar to Ethereum are on the way, first-mover advantage is huge in crypto (take Bitcoin, for example) and Ethereum is so embedded into the architecture of crypto that it still probably isn’t going anywhere.

Despite its high gas fees, countless people still use Ethereum because of the trust and functionality it provides. Some serious competitors (like Cardano led by Charles Hoskinson, for example) are slowly getting ready to launch, but there is plenty of room in crypto for multiple Blockchains, and the case for Ethereum remains strong. And there’s been a lot of talk of Ethereum addressing some of its major problems in the near future, so that’s something worth looking into next.

Road Map & Vision

Ethereum’s website (and its many diehard supporters) are quick to point out that something big is in the works – Ethereum 2.0. This snippet is taken from Ethereum’s official website.

The long-awaited Eth 2.0 seems to be the answer to all (or most) of Ethereum’s problems, so that is a good sign given it does have some major issues (namely scalability and sustainability). Clear timelines and spelt out goals are also great.

That being said, there are still those who believe that some other Blockchain will usurp Ethereum, but it’s always good to have a broad understanding of an investment and its sector before making a decision.

As for the vision, Ethereum seems to know what it’s doing. And it may just have what it takes to go all the way.

When you consider what Ethereum has already become, but more importantly what could become if mainstream society and institutions fully jumped onboard, there is still so much room for this already massive crypto project to grow. Ethereum’s use-cases span everything from digital identity to borrowing and lending to pretty much anything else a developer can think of, so the sky is the limit with a crypto like this.

The Community

So Ethereum’s community, judging from the market cap alone, is robust and well and truly alive. With a lesser-known crypto you might want to assess how active and prominent its community is, but we can safely assume Ethereum has enough supporters.

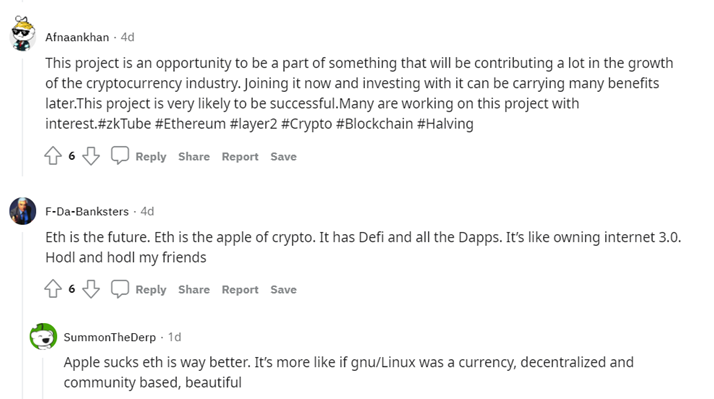

However, some invaluable insight can still be gained from going on Reddit and Telegram forums, as well as social media. People are often discussing the future of crypto projects, and this is a good place to see what people are saying on the ground – and yet another way to gauge how people are feeling about Ethereum right now (market sentiment). For example, a few comments on the latest Eth 2.0 Reddit thread has some relevant information for people thinking about investing:

With another comment showing that those looking for those infamous 100X crypto gains may want to look beyond Ethereum given its mainstream popularity.

The crypto universe is deep and there is always something more to learn from people who are active in forums. Just remember to take everything with a grain of salt, especially when someone seems like they have an agenda of their own. Put more weight on the opinions of those with a decent following and get as many perspectives as you can.

The Website, White Paper & Track Record

While you should have already had a poke around the Ethereum website (which is really well-designed as you’d expect from a top crypto), you might also want to do some further investigation and a look at the white paper. Although you can assume Eth’s white paper is tight – it’s the lesser-known crypto’s whose shoddy white paper might be the red flag you need to avoid a poor investment.

Finally, take a look at how long Ethereum has been around. Ethereum was launched in July 2015 and first traded on August 7 for $2.77. Six years later, Ethereum is still going strong, which is a good sign of longevity. The longer a coin has been around the more you can assume it will continue to maintain and grow its value.

News & Updates

Simply searching Ethereum in Google or other major news outlets like CoinDesk, Forbes and Coin Telegraph is a good way to see what’s currently happening with the project. Just glancing over some of the latest headlines tells you a bit about what’s going on with Ethereum and the market in general.

Financial metrics (trading volume, liquidity, coin supply)

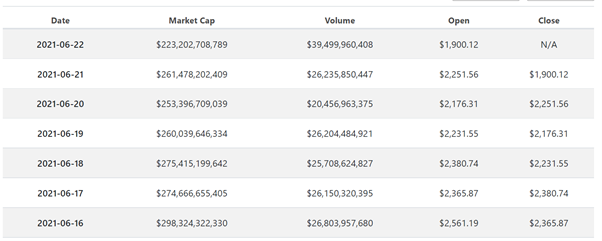

The 24-hour trading volume can help you see what Ethereum is doing in the short-term, giving you an idea if there is something substantial behind a recent dip or pump.

As we can see below (from Coin Gecko’s Historical Data tab), Ethereum has had steady volume for the past week or so until today, where the price is falling – the slight increase in today’s trading volume could indicate there is more conviction behind the most recent price dip (probably owing to the latest China crypto controversy) than the price moves in the last week, so it is advisable to be weary that Eth could continue to drop before bouncing back.

If we take a look back to last month when Ethereum was doing a bit better, we can see a massive increase in trading volume, particularly around the 24/5-26/5 period, indicating that the price surge had some real substance behind it and was likely to continue (which it did).

Given that Ethereum’s trading volume is usually $20 billion and above, liquidity is not much of a concern as there are lots of people willing to buy/sell it on a number of exchanges.

A glance at Ethereum’s circulating supply can also help give you a clearer picture of what kind of investment you are looking at. While there are around 116,000 Eth coins in circulation, Ethereum doesn’t have a total limit (like Bitcoin’s 21 million), which means a single Ethereum is less likely to see the astronomical heights that a single Bitcoin will.

However, looking into Eth’s coin supply you will find that:

The max supply of 18 million a year is a good sign as it means that though Eth is not capped, its supply is limited, suggesting its price per coin could maintain its value and grow in the long-term.

On-chain Metrics

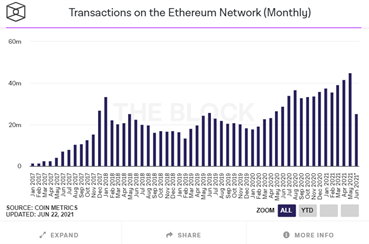

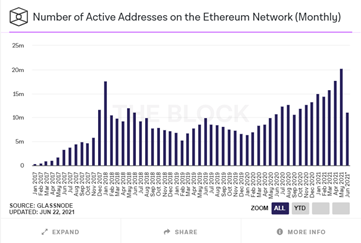

Now that we’ve covered most of the core fundamentals, By visiting https://www.theblockcrypto.com/data/on-chain-metrics/ethereum you can see some of the under the hood factors that help you judge an investment.

Both the transaction count and the number of active addresses seem to be in a bit of a slump this month, indicating the Ethereum’s bullishness has lost some steam. You could interpret this as a sign that Ethereum has corrected back down to its true intrinsic value, or if you’re feeling like Ethereum will be the way of the future, it could be the perfect time to buy. Given the promising analysis we have carried out so far, this may be a good opportunity to scoop up some Eth at a low price.

Weighing it all up

Now that you’ve had a good look at Ethereum’s key fundamentals, it’s time to weigh up everything you’ve found. Ethereum is undoubtedly a promising coin and a great way to get exposure to crypto without the risk of lower-cap coins. Its utility is second to none and it has proven to be highly valuable in both the crypto world and the mainstream.

However, it does have its challenges and there is no shortage of fierce competition. It’s also going through a bit of a slump right now (along with the rest of the market), so it may be worth waiting to see what happens, or dollar-cost-averaging in to mitigate your risk while picking up some of this promising asset while its down.

Finally, we’d just like to say that there is no one way to perform a fundamental analysis in crypto. There are dozens of variables which can help you determine the profitability of an investment and every person’s analysis will look different. FA is not an exact science, and the order in which you evaluate key fundamentals will vary from coin to coin. This is just one example of how to perform a fundamental analysis in crypto. We hope it’s been helpful.

Good luck!

Did this answer your question?

Digital Surge is the easiest way for Australians to buy, sell & store over 250+ cryptocurrencies. With extremely low fees, a uniquely user-friendly interface and a customer-support team you can rely on, getting involved in crypto has never been easier. Sign up today and enjoy safe, stress-free trading.

Crypto-curious? The time you spend here will be the best investment you ever make.

Enjoy effortless trading today

- ACN 620 473 109

- © 2021 Copyright Digital Surge